- Nano Balance Sheet Template

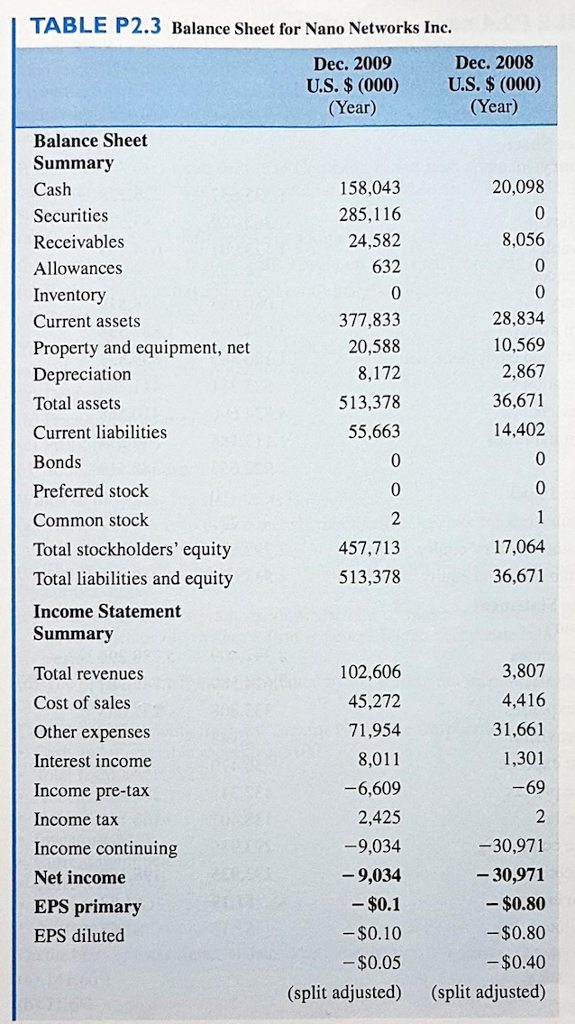

- Income Statement

- Nano Dimension Balance Sheet

- Nano Balance Sheet Sample

- Balance Sheet Example

Fuller, Smith & Turner PLC (LON:FSTA) has unveiled plans to raise around £53.6mln through a share placing to bolster its balance sheet ahead of the planned partial reopening of UK pubs on April 12.

The publican said it wanted to ensure it is “as well positioned as possible to reopen strongly once trading restrictions are lifted”, adding that the funds will also be used to help it return to pre-pandemic debt levels and increase its resilience in case of any delays or changes to the UK’s lockdown easing roadmap.

Nano Balance Sheet Template

READ: Coronavirus: UK government to extend pavement licences to support recovery for pubs and restaurants

Thanks to $71o million in equity funding in 2020, it finished 2020 with $670 million in cash on the balance sheet. Two subsequent offerings in 2021 raised an additional $833 million in gross. Get the specs, key features, prices, and availability details for Apple's 5G iPhone 12 mini, iPhone 12, iPhone 12 Pro, and iPhone 12 Pro Max. Nano-X said that it received 510(k) clearance from the FDA for its single-source Nano-X.ARC digital X-ray technology. That is a key part of the company's core technology, so getting the regulatory.

In a separate announcement detailing the fundraising, Fullers said it will conduct a non-pre-emptive placing of up to 6.5mln new ‘A’ shares at a price of 830p each, a 4.6% discount to its closing price on Tuesday, adding that it has also received irrevocable undertakings from directors who have also committed to contribute £225,000 in total to subscribe for shares. The company said the placing will be conducted by an accelerated bookbuild which will begin immediately.

The firm also said it is providing holders of its ‘B’ shares with the opportunity to purchase up to 4.4mln shares in the category in addition to the placing.

In addition to the fundraising, the company said it has agreed to a refinancing of its debt facilities with its banks, conditional on completion of the placing, which has extended the maturity date of its loans to February 23, 2023.

Fullers also provided an update on its current trading, saying that its monthly cash burn has averaged between £4-5mln during periods of full lockdown, although added that it is “well placed to reopen strongly” and expected “significant pent-up customer demand as the UK economy reopens”.

The company said it is planned to take a phased approach to reopening, with 82 sites to open initially with the remained of is managed pubs and hotels to be largely trading by May 17. It said around 70% of its tenanted inns are expected to open on April 12, when outdoor service will become permitted again.

Income Statement

Fullers added that assuming the UK timetable for lockdown easing is achieved, it will return to normalised trading conditions and become cashflow positive from mid-may onwards.

'The last year has been hugely demanding both for our business and the wider hospitality sector but we have risen to the challenges presented by the pandemic to emerge stronger, which is the Fuller's way. We have used the time wisely, rightsizing our teams, building our digital capabilities by continuing to innovate, as well as investing in our properties, and we are confident that we are in the best possible position to reopen”, Fuller's chief executive Simon Emeny said in a statement.

Nano Dimension Balance Sheet

'It was clear the demand for our premium pubs and hotels was as strong as ever when we were allowed to trade last year, which gives us confidence for the weeks and months ahead. Over half of the UK adult population has now had its first vaccine and we have a great team of people in place who are match fit and ready to welcome our customers back into our wonderful pubs and hotels. The additional financial flexibility we are seeking to put in place will enable us to further capitalise on the opportunities open to us as we execute our recovery plan and regain growth momentum', he added.

In a note on Wednesday, analysts at Peel Hunt upped their price target on the stock to 875p from 850p and retained their ‘hold’ rating, which they said reflected improvements in the firm’s portfolio as well as “less competition and a strong staycations market”.

The company’s shares were down 3.2% at 842p in mid-morning trading.

Nano Balance Sheet Sample

Balance Sheet Example

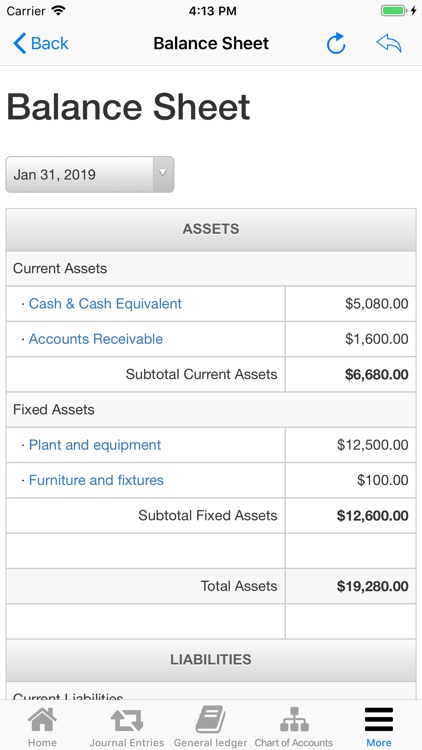

Nano Balance Sheet is an application for obtaining the financial information (balance, etc.) about the company or person. It can be used for bookkeeping or management accounting. Process of data input and obtaining reports is simplified as much as possible and does not require special knowledge.

You enter in the app all your business transactions, filling the Journals, and the application processes them according to the settings for each type of transaction and transferred to the General Ledger. The application generates following reports from General Ledger: Trial Balance, Balance Sheet, Income Statement, Capital Statement, Cash Flow, Debtors, Creditors.

Application already contains many types of customized business transactions. You can also easily adjust the other types of transactions. After installing the app also contains a ready-made chart of accounts, test business transactions and opening balances. After getting acquainted with the work of the application on the test data, you can remove them and start entering your data.